Anthony V. D'Amato NPN: 19177286

Nicole M. Robinson NPN: 21280132

SRG Consulting PLLC is a boutique consulting firm specializing in wealth management, wealth preservation, and strategic capital solutions for small business owners. The firm is structured to serve entrepreneurs and closely held businesses that require a disciplined, customized approach rather than mass-market financial products or one-size-fits-all advice.

SRG Consulting focuses on helping business owners protect, preserve, and strategically deploy capital through advanced planning methodologies. Its services include asset management and wealth-preservation strategies utilizing tools such as Roth IRAs, 401(k) rollovers, defined benefit programs, Fixed Indexed Annuities, Key Split-Dollar arrangements with Return of Premium policies, and advanced trust-based structures designed to improve tax efficiency, asset protection, and long-term continuity.

A core differentiator of SRG Consulting is its emphasis on structure and strategy over product sales. Engagements begin with a comprehensive understanding of the client’s business, financial objectives, growth plans, and long-term exit considerations. Solutions are tailored to align capital strategy with business operations, risk management, and legacy planning.

In 2026, SRG Consulting expanded its platform with the launch of a dedicated Small Business Financing division. This division provides access to a broad spectrum of capital solutions—including term loans, SBA financing, lines of credit, and working capital facilities—through a network of third-party lending partners. With more than 11 financing programs available, SRG Consulting evaluates each opportunity based on fit, financial readiness, and execution capability rather than volume or speed alone.

The firm’s process is intentionally selective, designed to work with business owners who value clarity, decisiveness, and long-term planning. SRG Consulting operates with a consultative, compliance-conscious approach, prioritizing transparency, documentation, and disciplined execution across both its wealth-preservation and financing platforms.

Frequently Asked Questions

As a Business Owner, What Weighs the Heaviest On Your Mind?

Question 1: Business Transition Planning: Have you created a plan to transfer your business to a certain party at an agreed upon price?

You need to consider a Buy Sell Agreement for when you're ready to sell your business and walk away.

Question 2: Business Preservation: Have you considered the impact on your business due to the departure or death of a key employee?

There are a couple of ways to deal with this, 1. Key man policy for your business. 2. There are hybrid key policies that are much more complicated contact us for details.

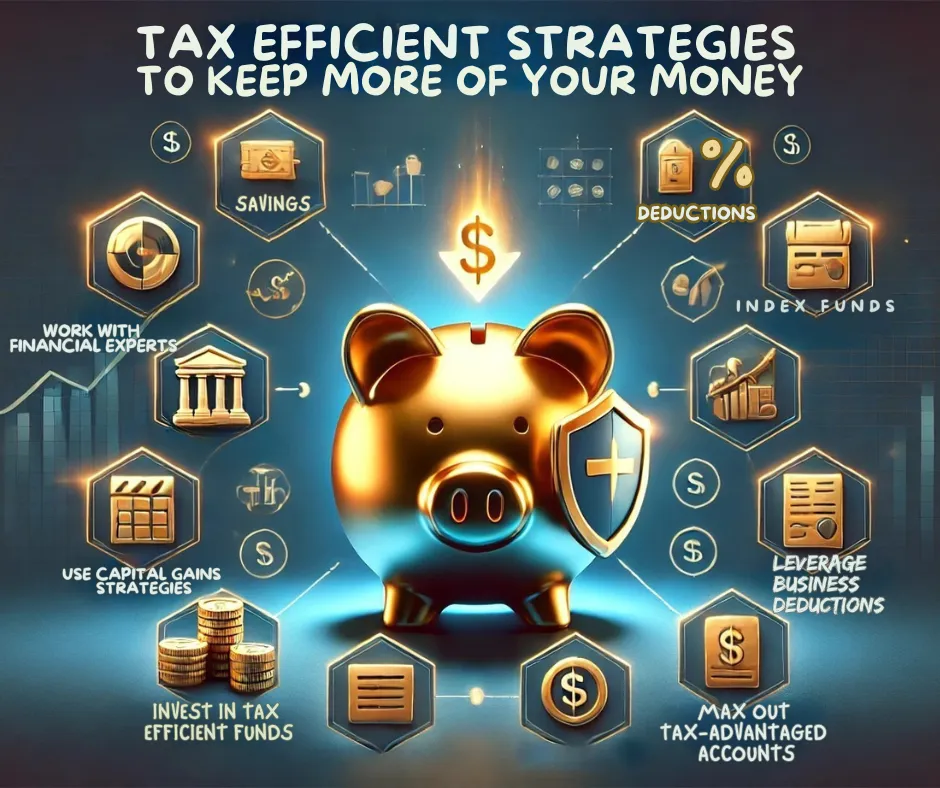

Question 3: Wealth Accumulation: Have you considered how to minimize the impact of taxes in attaining your personal wealth and retirement goals?

There are several different strategies that we have to obtain your goals. 1. Maximize Contributions to Tax-Advantaged Accounts Contributing to accounts like 401(k)s, Traditional IRAs, and Roth IRAs offers substantial tax benefits:

Traditional 401(k) and IRA: Contributions are made with pre-tax dollars, reducing taxable income in the contribution year. Taxes are deferred until withdrawals during retirement, potentially at a lower tax rate.

Finance Strategists Roth IRA: Contributions are made with after-tax dollars, allowing for tax-free growth and tax-free withdrawals in retirement, provided certain conditions are met. This is advantageous if you anticipate being in a higher tax bracket during retirement.

Implement Tax-Efficient Investment Strategies Selecting investments and managing them with tax efficiency in mind can reduce tax liabilities:

Asset Location: Strategically allocate assets between taxable and tax-advantaged accounts. Place tax-inefficient investments (e.g., bonds, real estate investment trusts) in tax-deferred accounts, and tax-efficient investments (e.g., index funds, ETFs) in taxable accounts to minimize taxes.

Tax-Loss Harvesting: Offset capital gains by selling investments at a loss, thereby reducing taxable income. This strategy can be particularly effective in volatile markets. Consider Roth Conversions Converting funds from a Traditional IRA or 401(k) to a Roth IRA can be beneficial:

Strategic Timing: Perform conversions during years of lower income to minimize the tax impact. This approach can reduce required minimum distributions (RMDs) in the future and provide tax-free withdrawals in retirement.

Key/Split Dollar Policy: Benefits for Your Business Tax Advantages:

Premium payments made by the business may be structured to minimize taxable income, potentially reducing overall tax liability. Additionally, the policy's cash value grows tax-deferred, offering further tax planning benefits.

Cash Flow Management: The policy accumulates cash value over time, which can serve as a source of funds for business opportunities or emergencies, providing financial flexibility when needed.

Employee Retention: Offering such a benefit can enhance employee loyalty and retention, as it provides them with valuable life insurance coverage and potential financial benefits.

Return of Premium: The ROP feature ensures that if certain conditions are met, the premiums paid are returned, making it a low-risk investment for your business.

Question 4: Estate Planning Has the successful transfer of your legacy to family or charity been considered in your planning?

Protecting Beneficiaries, Minimizing Tax Liabilities, Facilitating Charitable Giving, Ensuring Smooth Wealth Transfer, Upholding Personal Values and Legacy, Avoiding Family Conflicts, Adapting to Changing Circumstances. these are few things that doing a proper estate plan can provide.

Question 5: Executive Benefits Are there proactive steps you must take to retain, reward and recruit key employees?

Executive benefits are specialized compensation packages designed to attract, retain, and reward key employees within an organization. These benefits go beyond standard offerings, providing additional incentives that recognize the unique contributions of top talent.

Implementing comprehensive executive benefits is crucial for several reasons:

Attracting Top Talent, Retaining Key Employees, Rewarding Performance, Enhancing Employee Engagement When executives feel valued and adequately compensated, their engagement and commitment to the organization increase. Engaged executives are more likely to invest in their teams, drive innovation, and contribute positively to the company culture. This engagement can cascade throughout the organization, improving overall employee morale and productivity.

Proactive Steps to Implement Executive Benefits To effectively utilize executive benefits in retaining, rewarding, and recruiting key employees, consider the following steps:

Assess Organizational Needs: Identify the roles critical to your organization's success and determine the specific benefits that would most effectively attract and retain talent in these positions.

Design Competitive Packages: Develop benefits packages that are competitive within your industry and tailored to the needs of your executives. This may include non-qualified deferred compensation plans, executive bonus plans, or supplemental executive retirement plans.

Ensure Compliance: Navigate the legal and regulatory considerations associated with executive compensation to ensure all benefits plans comply with applicable laws and regulations.

Communicate Clearly: Effectively communicate the value and details of executive benefits to current and prospective executives. Transparency ensures that executives fully understand and appreciate the benefits offered.

Regularly Review and Adjust: Continuously assess the effectiveness of executive benefits programs and make necessary adjustments to remain competitive and aligned with organizational goals.

In conclusion, executive benefits are a strategic tool for organizations aiming to attract, retain, and reward key employees. By proactively implementing tailored benefits packages, companies can secure top talent, motivate high performance, and ensure long-term organizational success.

Comprehensive Wealth Management Solutions

Comprehensive wealth management services including investment advice, portfolio strategies, and retirement planning tailored to secure and grow your financial future.

Tax Strategy and Compliance

SRG Consulting assists with tax strategy, ensuring regulatory compliance and optimizing your financial benefits through meticulous tax planning and management.

Business Financial Strategy Consulting

Business Financial Advisory: Expert guidance on startup financing, cash flow management, and strategic business growth to foster long-term financial health.

What differentiates SRG Consulting from other financial brokers?

SRG Consulting combines personalized solutions with expert industry insight, prioritizing integrity and client-specific needs.

How does your wealth management service help individual clients?

Our wealth management service focuses on understanding your financial goals and risk tolerance, developing a personalized investment strategy that seeks to maximize returns while protecting your assets.

Can SRG Consulting help me with both personal and corporate tax issues?

Yes, we provide solutions for both individual and corporate tax planning and compliance.

What should I expect during a estate financial consultation with SRG

Expect a thorough market analysis, financial capability discussion, risk assessment, and tailored investment advice.

How does SRG Consulting support startups and small businesses?

We offer services covering business plan assessment, financial forecasting, funding strategies, and operational cash flow management to foster sustainable growth.

Is there a charge for an initial consultation at SRG Consulting?

We offer a complimentary initial consultation to discuss your financial situation and needs.